Debt Transparency: An Open Government Solution to Mitigating Debt Crises

Transparencia de la deuda: El gobierno abierto como solución para mitigar la crisis del endeudamiento

Growing debt over the last two decades has left many resource-rich African countries on the verge of debt crises. Since the early 2000s, African countries have steadily taken on increased amounts of debt while the quality of public institutions and debt management policies have deteriorated over the same period. As commodity prices dropped unexpectedly during the pandemic, countries have been left with even greater challenges for repaying debtOpenly disclosing information about government debt enables informed decision-making, mitigates the risk of financial instability, and allows citizens to hold their governments accountable for respons... More.

Hidden debts account for a significant portion of this new debt. Chinese lending for big infrastructure projects – much of which is not officially tracked – has contributed significantly to new debts since the mid-2000s. And these hidden debts complicate efforts to mitigate debt crises. A lack of transparency around debt owed to China and other lenders makes it difficult for international financial institutions (IFIs) to accurately estimate countries’ debt burdens, provide recommendations to limit debt distress, and determine appropriate debt relief packages.

Why Debt TransparencyAccording to OGP’s Articles of Governance, transparency occurs when “government-held information (including on activities and decisions) is open, comprehensive, timely, freely available to the pub... More Matters

Debt transparency is a cornerstone of accountable, sustainable management of debt that can benefit leaders and citizens alike. Debt transparency can:

- Maintain sovereignty over domestic infrastructure and natural resources. Secrecy around the amount and terms of debt repayment has forced some countries to make steep concessions or cede control of their resources to China.

- Encourage investment from potential lenders. Debt transparency allows potential lenders to more accurately assess risks associated with buying bonds issued by particular countries. By contrast, uncertainty about countries’ debts leads lenders to increase the cost of borrowing or avoid investing at all.

- Increase government credibility. When governments lose the confidence of investors and their funding, they have reduced capacity to deliver key services to citizens. As a result, the public may become unsatisfied with or lose confidence in elected officials.

The Open Government Solution

An open government approach – incorporating transparency, participation and public accountabilityAccording to OGP’s Articles of Governance, public accountability occurs when ”rules, regulations, and mechanisms in place call upon government actors to justify their actions, act upon criticisms ... More – can help tackle the challenges relating to hidden debts. Here are a few reform recommendations OGP members can take to get started.

- Create a clear legal framework for public borrowing which includes transparency and oversight. Public debt management objectives, strategy, and processes should be publicly accessible and may be outlined in legislationCreating and passing legislation is one of the most effective ways of ensuring open government reforms have long-lasting effects on government practices. Technical specifications: Act of creating or r.... Such legislation should cover borrowing from private and public sources.

- Publish an annual strategy defining how the composition of the debt is projected to evolve over the medium term. This should include an analysis of risk and cost, and take into account the constraints the country faces.

- Increase the transparency of macro-economic indicators related to debts, including the government debt-to-GDP ratio, debt-carrying capacity, the stock of domestic and external debts, and the interest due on these debts. For each indicator, publish the underlying data sources and the method used in calculations.

- Increase transparency of parallel indicators, including current account balance, GDP growth, remittance payments, and reserve coverage.

- Conduct and publish debt sustainability analysis to assess debt vulnerabilities and minimize debt distress. Resources such as the IMF-World Bank Debt Sustainability Framework for Low-Income Countries can guide countries in such analysis.

Debt transparency has so far been relatively unexplored in OGP commitments, including those by OGP members in Africa. Notably, in its 2017 action plan, Ghana made a commitmentOGP commitments are promises for reform co-created by governments and civil society and submitted as part of an action plan. Commitments typically include a description of the problem, concrete action... to publish information on fiscal deficits, the government’s borrowing, and debt management. However, none of this information has been made accessible to the public so far. Sierra Leone, more foundationally, carried out a census of all existing treasury accounts, an important step to accounting for debt. As more than 100 OGP members begin this year’s co-creation processCollaboration between government, civil society and other stakeholders (e.g., citizens, academics, private sector) is at the heart of the OGP process. Participating governments must ensure that a dive... and consider the ways in which they can build back better from the COVID-19 crisis, debt transparency presents an opportunity for countries to invest in their own futures.

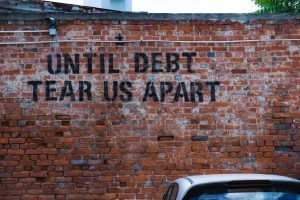

Featured Image Credit: Ehud Neuhaus via Unsplash

El endeudamiento de los países, acrecentado en las últimas dos décadas, ha dejado a muchos países africanos ricos en recursos al borde de una crisis de endeudamiento. Desde principios de los años 2000, los países africanos han adquirido cada vez más deudas y, al mismo tiempo, la calidad de las instituciones y políticas de manejo de deudas se han deteriorado. Los precios de muchas mercancías han caído durante la pandemia, por lo que muchos países están teniendo aun mayor dificultad para pagar sus deudas.

Las deudas ocultas representan una parte importante de esta deuda. Los créditos chinos para los grandes proyectos de infraestructura – una gran parte de lo cual no se encuentra en los registros oficiales – ha contribuido de forma importante a las nuevas deudas que han surgido desde mediados de la década de los 2000. Estas deudas ocultas están complicando los esfuerzos de atención a las crisis de endeudamiento. La falta de transparencia alrededor de la deuda a China y a otros acreedores limita la capacidad de las instituciones financieras internacionales de estimar las deudas, presentar recomendaciones para reducir los problemas asociados a ellas y establecer esquemas adecuados para aliviarlas.

La importancia de la transparencia de la deuda

La transparencia de la deuda es un elemento central para la rendición de cuentas y el manejo sostenible de las deudas, trayendo beneficios a los líderes y a la ciudadanía. La transparencia de la deuda puede contribuir a:

- Mantener la soberanía de los países sobre su infraestructura y recursos naturales. La opacidad sobre los montos y términos del pago de las deudas ha orillado a algunos países a hacer concesiones excesivas o a ceder el control de sus recursos a China.

- Promover inversiones. La transparencia de la deuda permite a los potenciales inversionistas evaluar los riesgos asociados a comprar bonos emitidos por los países. Por el contrario, cuando hay incertidumbre sobre la deuda de los países, los inversionistas tienden a aumentar los costos asociados a sus préstamos o incluso a no invertir.

- Incrementar la credibilidad de los gobiernos. Cuando los gobiernos pierden la confianza de los inversionistas y por lo tanto el acceso a sus fondos, tienen una menor capacidad de prestar servicios a la ciudadanía. Como consecuencia, el público podría reducir su nivel de satisfacción y confianza en los funcionarios electos.

El gobierno abierto como solución

El gobierno abierto – transparencia, participación y rendición de cuentas – puede ayudar a atender los retos asociados a las deudas ocultas. A continuación presentamos algunas recomendaciones de reformas que los miembros de OGP pueden adoptar.

- Establecer un marco legal para el endeudamiento público que incluya elementos de transparencia y supervisión. Los objetivos, estrategias y procesos asociados al manejo de las deudas públicas deben ser de acceso público y esto puede quedar definido en la legislación. La legislación debe abarcar las fuentes públicas y privadas de inversión.

- Publicar una estrategia anual en la que se defina una proyección de la composición de la deuda para el mediano plazo. Deberá incluir un análisis de los riesgos y costos asociados, además de las limitaciones que enfrenta el país.

- Incrementar la transparencia de los indicadores macroeconómicos relacionados con la deuda, incluyendo la relación deuda-PIB, capacidad de carga, las reservas de deuda interna y externa y el interés que se debe sobre esas deudas. Para cada indicador, se deberá publicar las fuentes de datos correspondientes y el método utilizado para dichos cálculos.

- Incrementar la transparencia de los indicadores paralelos, incluyendo los saldos, crecimiento del PIB, pagos de remesas y reservas.

- Llevar a cabo y publicar análisis de la sustentabilidad de la deuda para evaluar la vulnerabilidad de la deuda y minimizar las posibles complicaciones. Existen algunos recursos que pueden orientar a los países para llevar a cabo dichos análisis como el Marco de sustentabilidad de la deuda para países de bajos ingresos del Banco Mundial-FMI.

Hasta la fecha, el tema de transparencia de deuda ha sido relativamente poco explorado como parte de los compromisos de OGP, incluyendo los países de África. Un caso notable es el plan de acción de 2017 de Ghana, que incluye el compromiso de publicar información sobre los déficits fiscales, el endeudamiento del gobierno y el manejo de la deuda. Sin embargo, hasta el momento esta información no se ha puesto a disposición del público. Sierra Leona, por su parte, llevó a cabo un censo de todas las cuentas de la tesorería como un paso importante para contabilizar la deuda.

Este año, más de 100 países miembros de OGP están iniciando sus procesos de cocreación e incorporando medidas para recuperarse de la crisis del COVID-19, la transparencia de la deuda representa una oportunidad de invertir en el futuro.

Comments (1)

Leave a Reply

Related Content

Domestic Resource Mobilization and Economic Recovery in Africa

Explore eight ways open government reform can help African countries recover from the immediate crisis and restore their progress towards achieving the Sustainable Development Goals.

Fiscal Openness in OGP

Fiscal openness encompasses a wide range of practices and interventions aimed at promoting transparency, participation, and accountability. It is the most popular policy area in OGP.

Ghana

Ghana’s fourth action plan achieved notable early results in implementing the Access to Information Law and publishing information on companies’ beneficial owners. Gradual progress across action plans and increasingly strategic…

sergio antonio aguirre Reply

Considero importante el tema de la transparencia de los gobiernos en la deuda, seria mejor si los organismos internacionales y paises acreedores colaboraran en en presentar los resultados de sus creditos, en virtud que mucho de ellos se pierde un buen porcentaje en corrupción y gastos de funcionamiento de burocracia nacional e internacional.